With ,

,

,

your pet, it is your little love ball and your loyal partner. You love him more than anything. You try your best to make him healthy and happy around you. But sometimes, veterinary fees can put a heavy burden on your budget, and you may not be able to take care of your partner as you want. This is particularly true in the case of illness or accidents, which may rapidly increase costs. Have you ever thought about how to reduce your veterinary expenses and provide the best care for your partner? This is provided by animal health insurance, which can reimburse 100% of veterinary expenses!

summary

franchise: by contract, claim or year? Annual franchise: the simplest and most favorable! Deductible for everything: most unfavorable deductible: deductible for everything: “middleman” tariff: personalized? For more information about the

service, you have decided to purchase animal health insurance to provide your partner with the best possible care while controlling your budget. What criteria should be compared? What questions should you ask before you buy?

to help you choose the best animal health insurance, we have listed important criteria to compare when searching.

deductible: by contract, claim or year?

in animal health insurance is not so much a deductible as its type. There are three types of deductibles: annual deductible, contractual deductible and claim deductible. What is the “deductible” in

and

insurance? This is a fixed amount or percentage that will be deducted from one or more of your claims.

may seem quite simple at first glance, but the situation is a little complicated for different types of franchises. The following is a summary to help you better understand this principle:

annual franchise: the simplest and most advantageous! The annual deductible of

will be deducted one or more times until it reaches its amount. So what? Nothing else! This is the most advantageous and should therefore be given priority. Please note that in order not to be surprised, the annual deductible can be deducted once or more (therefore, it can be deducted on one or more invoices according to the difference between the annual deductible and the amount of your first invoice in the year).

the following is an example to better understand:

You have chosen an animal health insurance plan with a refund rate of 80% and a deductible of 50 euros per year.

your dog has gastroenteritis. You take him to the vet. After consultation, you will submit your first claim of the year to your insurance company. Your first veterinary invoice is 100 euros.

the following is how the insurance company calculates your refund:

applies the refund rate in your formula to the total amount of your invoice: 80% of 100 euros = 80 euros, and then the insurance company deducts a deductible of 50 euros per year. 80 € – 50 € = 30 €. Therefore, the total amount of the first invoice will be returned to you is 30 €.

in this example, the refundable amount on the invoice (before applying for the deductible) is greater than the annual deductible (80 euros > 50 euros). Therefore, the latter can be deducted at one time.

and

, but if the refundable amount on your first invoice is less than the annual allowance, you will not receive a refund on your first invoice. The deduction of the annual allowance will be allocated to the first invoice and the next invoice, J

take the first invoice of 50 euros and the same insurance policy as an example. How will you get a refund:

first refund request:

invoice 50 euros – > 80% of 50 euros = 40 euros refundable – 50 euros deductible = – 10 euros. You will not receive any refund for this invoice, you will receive a deductible of 10 euros from the next invoice.

the second refund application invoice 70 euros – > 80% of 70 euros = 56 euros minus the remaining 10 euros annual deductible = 46 euros. The second invoice will be returned to € 46. The annual allowance has now been paid in full. Your next refund request will not apply to any deductible.

third refund request:

accounts for 80% of your total invoice, that’s all! The deductible for the next year will apply to your first claim in the next year.

, not the deductible for “every action” or “every claim”, once the total annual deductible (one or more) is reached, Your next claim will not deduct any other deductible before the next year! Deductible for each act of

: the deductible for each act of the most unfavorable

is a percentage (not an amount) in each line of your veterinary bill (not in your total bill!) in a year.

but that’s not all! Behind the deductible of each act, there is a “minimum deductible” that can be used if the deductible percentage applied to the veterinary act in your invoice is lower than the minimum deductible, Therefore, this agreement will apply the minimum deductible (not the percentage deductible…).

kezako? The following is a clearer example:

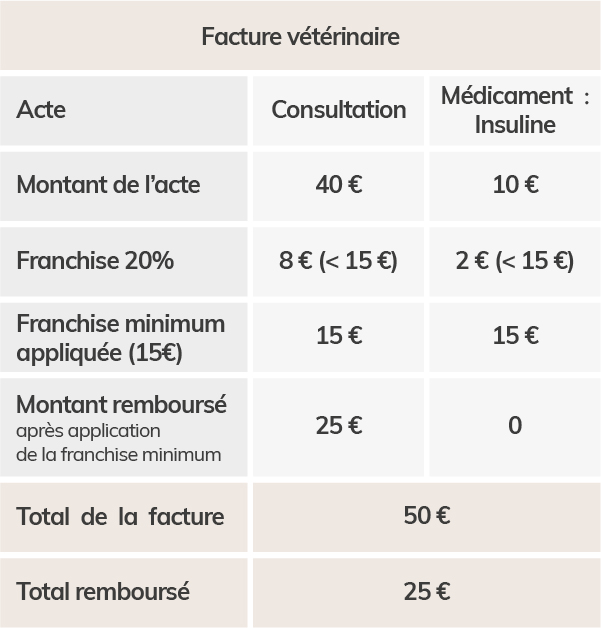

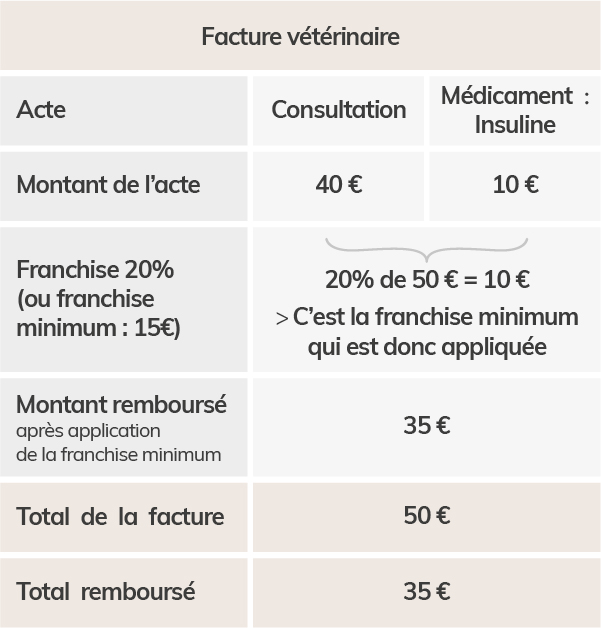

you have purchased the following animal health insurance formula:

receives suggestions from woopets through registered newsletters. I register your email address collected by woopets so that you can receive our news and transaction offers. Learn more refund rate: 100% deductible / time: 20% minimum deductible: 15 euros

your cat has diabetes (a chronic disease). Every month, your veterinarian will charge 50 euros for your cat’s counseling and insulin treatment. The following invoices are provided to you.

the deductible for each invoice on this invoice is as follows: by applying a 20% deductible to the amount of each invoice, the amount obtained is always lower than the minimum deductible (15 euros). Therefore, the minimum deductible (15 euros) will be deducted from the amount of each contract.

, which is why the formula of 100% refund rate and 20% deductible is more unfavorable than the formula of 80% support rate and annual deductible!

we strongly recommend that you do not purchase an insurance plan applicable to the deductible system of each contract, because eventually you will lose the deductible of each claim of

: “middleman” and

Is a percentage that is systematically deducted from the total amount of your invoice during the year (unlike the deductible of each agreement, the deductible of each agreement is deducted from each amount constituting your invoice).

is the “minimum deductible” like the deductible of each agreement If the amount obtained by applying the deductible percentage is lower than the minimum deductible, you can apply the deductible percentage instead of the deductible percentage for each claim.

kdspTake a cat with diabetes as an example to understand what the deductible means:

conclusion? Be very careful when reading all statements (general and special provisions) Finally, choose the annual deductible: you know the total amount of your deductible from the beginning of the contract. There is no bad surprise!

price: personalized?

can be found in animal health insurance now It is important to remember that a low and attractive price can never represent good health insurance and sufficient refund! Please note that when the starting price is very high (too much?), your premium may increase significantly in the second year Attractive…

also pay attention to the insurance plan that only covers accidents (even post accident surgery) but does not include diseases! Contrary to the traditional concept, pets are far more likely to get sick than accidents…

“Therefore, it is best to choose a fully formulated insurance (” all risks “: disease, accident, surgery) and according to your animal species, characteristics and needs (rather than a very low formula, it will hardly give you any return…)

in fact, a cat and a dog cannot be insured at the same price, which will not have any impact on the guaranteed quality in the insurance contract. The same is true for two different breeds of dogs.

For example, Jack Russell’s ADHD makes the heart more fragile, while Border Collie (Shepherd) is stronger at this point. Short headed animals (such as carlins, bulldogs, etc.) are prone to breathing difficulties due to the nose This means paying higher premiums to get better protection to meet their needs.

and

are “good” Animal health insurance will take into account all these criteria and will adjust its rate according to the needs of each animal in order to obtain the best protection in its life. Finally, behind a cheap and attractive formula, there is usually a franchise right for every behavior or disaster… When the repayment time comes, there will be many bad surprises!

service revolves around

service In addition to the quotation itself, it is important to compare the services provided by the insurance company in its quotation.

Are these steps immaterial and therefore 100% digitized to simplify operations? Do they provide easy access to custom client space? Can the client space also be accessed through mobile applications? Are client services provided over the phone, and the number and range of days per hour? Submit a claim? How long does it take to analyze the claim? What is the deadline for reimbursement? Do they provide included services? For example, veterinary emergency services when your veterinary clinic is closed?

There are many questions to ask you to determine which insurance is best for you and your partner. “